Don't wait for an IRS audit to find out that your 401(k) plan is out of compliance.

The IRS's 401(k) Plan Checklist is a helpful tool to help assess whether your plan has fallen into the trap of the IRS's Top Ten Failures submitted for its ...

[Read more] about The IRS 401(k) Plan Checklist

Search Results for: EPCRS

Employee Benefits Law: A Glossary

| # | A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z | #

Employee benefits law is complex. Our team wrote this glossary of employee benefits law as a quick starting point for those seeking ...

[Read more] about Employee Benefits Law: A Glossary

Government Plans

We solve employee benefits problems for public agencies. Our attorneys have the specialized law expertise to help public agency or “governmental” plan providers develop excellent and compliant benefits plans. We also have the unique expertise to ...

[Read more] about Government Plans

457(b) and 457(f) Plans

Guiding You Through Your 457 and Other Retirement Plan Options

Working with Employee Benefits Law Group to review your retirement plan can help you determine the right plan you should offer your employees.

We have the resources and expertise to ...

[Read more] about 457(b) and 457(f) Plans

Retirement Plans

Plan sponsors and fiduciaries rely on Employee Benefits Law Group for all aspects of their retirement plans. Whether it’s designing and setting one up from the start, improving an existing plan, or assessing a plan for compliance, we help clients ...

[Read more] about Retirement Plans

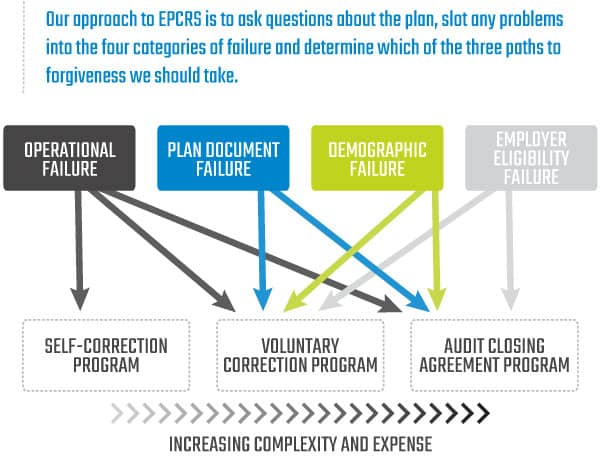

Corrective Compliance

The Most Common Benefits Plan Errors

There's a cloud to the silver lining of a qualified plan's tax advantages - the responsibility for compliance in both form and operation with the requirements of the Internal Revenue Code. Failure to meet ...

[Read more] about Corrective Compliance