Don't wait for an IRS audit to find out that your 401(k) plan is out of compliance.

The IRS's 401(k) Plan Checklist is a helpful tool to help assess whether your plan has fallen into the trap of the IRS's Top Ten Failures submitted for its ...

[Read more] about The IRS 401(k) Plan Checklist

Search Results for: EPCRS

Employee Benefits Law: A Glossary

| # | A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z | #

Employee benefits law is complex. Our team wrote this glossary of employee benefits law as a quick starting point for those seeking ...

[Read more] about Employee Benefits Law: A Glossary

Retirement Plans

Plan sponsors and fiduciaries rely on Employee Benefits Law Group for all aspects of their retirement plans. Whether it’s designing and setting one up from the start, improving an existing plan, or assessing a plan for compliance, we help clients ...

[Read more] about Retirement Plans

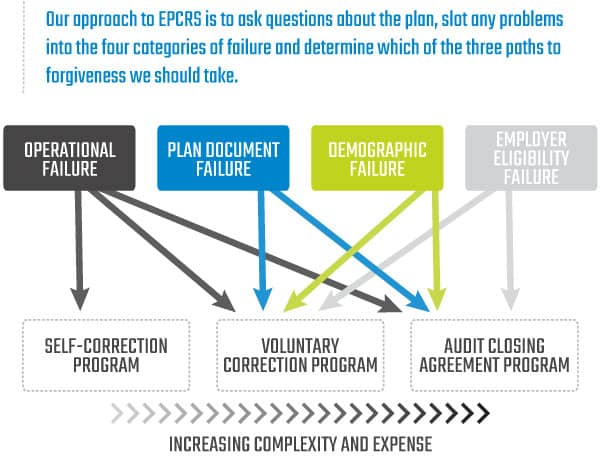

Corrective Compliance

The Most Common Benefits Plan Errors

There's a cloud to the silver lining of a qualified plan's tax advantages - the responsibility for compliance in both form and operation with the requirements of the Internal Revenue Code. Failure to meet ...

[Read more] about Corrective Compliance

Marcel Weiland

Shareholder

Marcel handles all areas of employee benefits law that impact private sector and nonprofit employers, including ERISA and Internal Revenue Code compliance. He focuses on qualified retirement plans, including ESOPs.

For 20 years, ...

[Read more] about Marcel Weiland

ESOP Restatements And Submissions … Making The Most Of Your Relationship With The IRS?

By now, all companies sponsoring ESOPs should be aware that their plan documents must be restated and submitted to the IRS every five years for a letter of determination of their tax qualified status. What they may not realize is that the ...

[Read more] about ESOP Restatements And Submissions … Making The Most Of Your Relationship With The IRS?