This article will acquaint you with the utility of the ESOP as both a technique of corporate finance and an employee benefit plan. It is important to note, however, that there are other qualified retirement plans that can be used to invest in stock of the employer sponsor. There are profit sharing plans, stock bonus plans which are not ESOPs, and combinations of 401(k) arrangements and profit sharing plans (and even to some extent defined benefit plans and money purchase pension plans). An ESOP, even with its different variations, is just one of the alternatives. You can find answers to other questions you may have in our ESOP Video FAQs.

Overview of Three Types of ESOPs

From a tax law standpoint, the Internal Revenue Code (IRC) defines only one plan as an ESOP. However, to conceptualize the different uses of ESOPs, we will discuss three “types” of ESOPs. Although these three “types” are really three “uses,” in practice it helps to think of ESOPs in this manner. All transactions involving ESOPs are simple or complex variations of one of these three types.

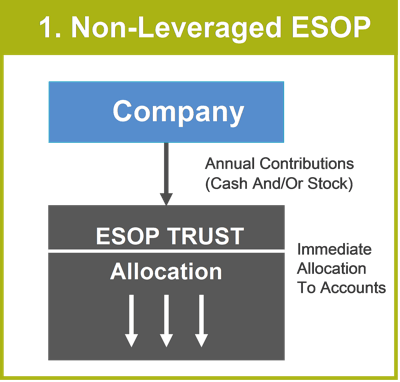

1. Non-Leveraged ESOP – The Stock Bonus Plan

This first type of ESOP (Diagram 1) does not involve borrowed funds to acquire the company stock. It is funded by contributions of cash or stock directly from the employer sponsor. Since shares are contributed to the ESOP accounts of employees, it is referred to as a “stock bonus plan.”

Shares of stock contributed by the corporation are “newly issued shares.” These shares are immediately allocated to participants’ accounts, just like in a typical profit sharing plan. New shares are issued by the corporation to the ESOP (some would say “out of treasury shares”). The corporation gets a deduction for their appraised fair market value as of the date of contribution. Cash can also be contributed to the plan in annual discretionary amounts to purchase shares at a later date, or simultaneously, from either the corporation or from another shareholder.

Generally, a non-leveraged ESOP is established to promote growth of the company sponsor by creating tax deductions with newly issued shares, thus improving cash flow and reducing taxes. It is also one of the best plans for gradual accumulation of retirement benefits tied to the value of employer stock and for promoting participatory management structures. It is the only way to give employees a stock benefit that is deductible by the company. The purpose of the ESOP can be to purchase shares from a shareholder on a cash flow basis where the tax incentives attributable to leveraged ESOPs are either not important or the company does not want to borrow to fund some or all of the transaction(s). Using a non-leveraged ESOP will avoid the impact of debt on the corporation’s value and balance sheet. Also, funding an ESOP on a cash flow basis suggests that the company’s obligation to repurchase shares from departing participants may be easier to manage than with the leveraged variety. This corporate obligation is called “repurchase liability.” Table 1 is a brief comparative example of the ESOP’s cash flow advantage over non-ESOP.

Table 1

| Comparing ESOP Tax and Cash Flow Advantage | No Employee Benefit Plan | Employee Benefit Plan | ESOP |

|---|---|---|---|

| Pre-Tax Income | $150,000 | $150,000 (Cash) | $150,000 (Stock) |

| Contribution / Deduction | $0 | $50,000 | $50,000 |

| Taxable Income | $150,000 | $100,000 | $100,000 |

| Income Tax | $60,000 | $40,000 | $40,000 |

| Net Income | $90,000 | $60,000 | $60,000 |

| Cash Flow | $90,000 | $60,000 | $110,000 |

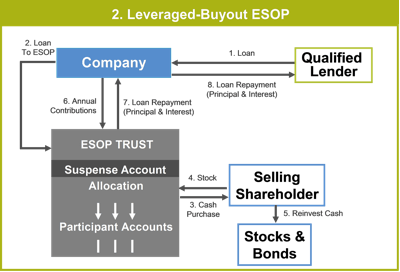

2. Leveraged Buyout ESOP

This form of leveraged ESOP (Diagram 2) uses financing to buy stock from a selling (and often retiring) shareholder. The financing may come from a bank; or the seller can accept a promissory note from the ESOP or the company, providing the financing for the transaction. These can be small minority transactions, or up to 100% of the company stock in one deal. The tax incentives that accompany these types of transactions include tax deferred capital gains and tax favored financing.

These transactions have gained notoriety as a succession planning tool for closely held businesses. In contrast to the Issuance ESOP, no dilution is suffered by existing shareholders.

They can be very compelling from an estate planning or succession planning viewpoint. A seller who properly structures his transaction may sell his stock to an ESOP and not pay any immediate capital gains tax on the sale. The seller may reinvest the sale proceeds within 12 months of the stock sale to the ESOP and defer the capital gains tax liability indefinitely (known as a “1042 Rollover Transaction). This is much like the former IRC provision that allowed one to reinvest the proceeds from the sale of your house into another home, or a tax deferred real estate exchange under IRC section 1031. As a result, the seller will have all of the deferred capital gains and tax savings at work in his reinvestment portfolio.

The company, in turn, will pay the purchase price entirely in deductible pretax dollars. The debt principal (and interest) is paid for with pretax dollars by making contributions to the ESOP. It is the only tax deductible loan principal in the IRC. For an S corporation ESOP, sellers cannot rollover and reinvest tax deferred, but the S corporation distributions used to pay taxes can be used by the ESOP to pay for the stock (more on that in another article). This is a direct tax subsidy for selling stock to an ESOP.

Shares are allocated to employee accounts as the loan is repaid. The amount of the allocation is based on the loan terms. Simply put, if the loan is a ten year loan, the participants will get 10% of the shares released and allocated to their accounts each year. The shares are allocated to the participants’ by being released from a special ESOP account, called a “suspense account,” to the ESOP participants’ accounts according to formulas developed by the IRS. Another consequence is that the corporation’s future repurchase liability will be equal to the fair market value of the stock purchased by the plan and allocated to employee accounts.

Shareholders who do not sell their shares to the ESOP may find themselves competing with the corporation for assets with which to sell their stock in the future, if repurchase liability or growth in the stock value, or a combination of both, create a significant drain on corporate cash flow. It is also not prudent to overburden a company with too much ESOP debt. It is easy to find lenders to fund these transactions.

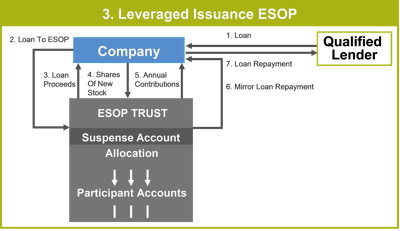

3. Issuance ESOP

An “Issuance ESOP” (Diagram 3) uses financing to acquire newly issued shares from the employer sponsor. The contribution and allocation of shares to employees is the same as for a Buy Out Leveraged ESOP.

The corporate advantages of an Issuance ESOP are that it creates tax advantaged financing for purchasing capital goods, for expanding by merger or acquisition, or simply by increasing capital formation. For whatever purpose, the principal borrowed to buy the stock effectively becomes tax deductible by virtue of it being repaid via plan expense/contributions. The company is therefore able to borrow working capital on a fully deductible basis.

Several side effects of Issuance ESOPs must be considered. First, they have a dilutive effect on existing shareholders if company value does not grow faster than the value of the percentage of stock sold to the ESOP. Second, there is repurchase liability for the future retirement benefits in the plan. The company will some day have to repurchase shares distributed from the ESOP to participants. For whatever purpose, therefore, the ESOP is effectively permitting the company to “borrow from its retirement plan” by permitting current deductions for contributions that are used as capital in the company, until benefits need to be paid. This improves the corporation’s cash flow, pending a required retirement or other future distribution when shares are distributed and repurchased.

What to Do?

In order to fully understand whether some type of ESOP or ESOP transaction can be good for a company and its employees, it is critical to first identify the objectives of all those involved. Often there are overlapping and conflicting objectives. For example, the company’s expansion objectives or other shareholders’ objectives, may compete with the objectives of the potential selling shareholders. Furthermore, the impact of an ESOP on the employees and the ability to motivate employees must be seriously considered.

Our firm has a wide range of outlines and information, including employee questionnaires, feasibility studies, and suitability evaluation, i.e. is an ESOP right for you and your company? We provide the necessary Guidance, more than just legal advice covering these various ESOP strategies and the related tax, financial, and employee benefits issues which accompany them. Furthermore, information and assistance from organizations like the National Center for Employee Ownership (NCEO) and The ESOP Association can go a long way towards helping you answer these questions.

How Do I Know if I Should Consider a Leveraged or Non-leveraged ESOP for My Company?

In this concise video, ESOP attorney Kevin Long explains how.

Updated July 15, 2024